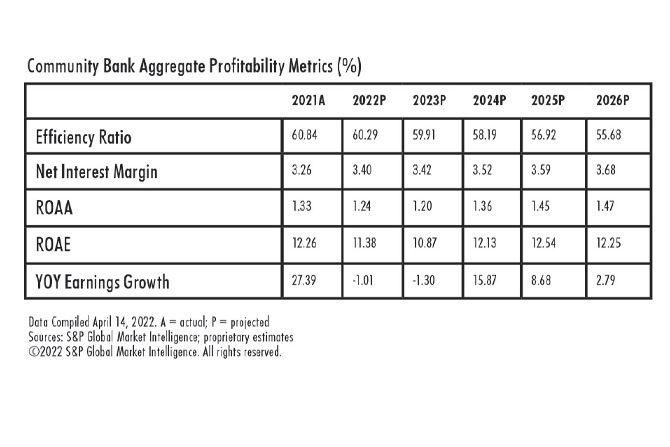

Earnings at U.S. community banks in aggregate are expected to dip 1% in 2022 as higher credit costs and lower fee income mitigate the benefit of net interest margin expansion.

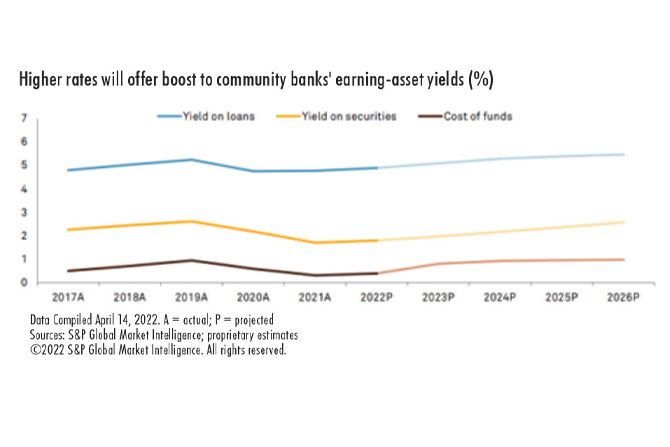

Fed actions to combat elevated inflation through rate hikes and the shrinkage of its $9 trillion balance sheet will boost community bank net interest margins by 14 basis points in 2022 and another 2 bps in 2023. Even after that expansion, margins would remain 21 bps below pre-pandemic levels.

Deposit betas, or the percentage of rate changes banks pass on to customers, will be lower than in past tightening cycles due to the massive influx of liquidity into the banking system during the pandemic.

Community bank margins will jump as the Federal Reserve raises short-term interest rates and loan balances increase with economic recovery. Still, earnings are unlikely to grow in 2022 and 2023 as credit costs normalize and fee income declines. Credit trends should normalize in 2022 due to a lack of pandemic relief efforts and rising operating costs stemming from elevated inflation, requiring higher levels of provisions for loan losses. Community banks will have to grapple with higher wages as well, limiting efficiency improvements. Fee income surged over the last two years on strength in mortgage banking income, but higher rates should reverse the trend in 2022. Taken together, a rising rate environment and sustained economic recovery from the pandemic will create a more favorable operating environment for community banks, but earnings growth could be hard to come by in the near term.

About the U.S. Community Bank Market Report

S&P Global Market Intelligence examines the U.S. government’s and the Federal Reserve’s efforts to mitigate the economic blow of the pandemic, the inflation that followed during the economic recovery, and the impact those actions have had on community banks’ profitability and credit quality. We acknowledge the likelihood of market-changing events occurring over a five-year period but have created projections for 2022 through 2026 based in part on IHS Markit economists’ expectations for interest rates, unemployment and economic growth. Projections are based on management commentary, discussions with industry sources, regression analysis, and asset and liability repricing data disclosed in banks’ quarterly call reports. While considering historical growth rates, Market Intelligence often excluded from its analysis the significant volatility experienced in the years around the credit crisis.

Despite margin pressure, community bank returns above pre-pandemic levels

Community banks’ net interest margins have come under considerable pressure as their balance sheets were flooded with excess liquidity, but returns ended 2021 above pre-pandemic levels due to explosive growth in fee income.

Earnings growth challenging despite margin rebound

Lower credit costs and strength in fee income overshadowed further net interest margin compression in 2021, and earnings jumped 27% from year-ago levels. The Fed began tightening monetary policy in mid-March 2022, with the first of a series of expected rate hikes that will offer a boost to margins. Still, higher credit costs and weaker noninterest income will create difficult year-over-year comparisons in 2022. Regulatory pressure and emerging competition from neobanks should contribute to weaker noninterest income as many large institutions have eliminated overdraft fees. Lower refinancing activity due to higher interest rates should also pressure mortgage banking income, with the Mortgage Bankers Association forecasting in mid-April that origination activity could plunge 35.5% from year-ago levels.

Rate hikes bring deposit betas in focus

While excess liquidity will remain a headwind to earnings, the glut of cash sitting on community bank balance sheets means institutions will not have to react that quickly to increases in short-term rates by raising their deposit costs.