Well . . . at least not in real time.

I recently heard a senior lending officer proclaim, with obvious relief, “Looks like we’ve dodged the recession bullet. We’re refocusing on loan growth opportunities.” The Fed-orchestrated “soft landing” is, of course, what our industry desires, but history clearly warns that it can take years before the effects of macro events such as pandemics, rate shocks and rampant inflation actually show up in lower credit quality. Even as these triggering events subside or abate, the lesson is clear: We shouldn’t let our guard down yet.

The Good

Despite weaknesses in specific sectors of the economy, overall job growth and unemployment have remained resilient in the face of perceived economic pressures. The inflation rate in December fell to 3.4% vs. 6.5% a year earlier, and the Federal Reserve has hinted at lowering interest rates soon in response. While current rates are moderate compared to standards set in the ‘70s and ‘80s, cutting interest rates will certainly be a boon for the nearly-decimated mortgage industry and other lenders.

The Bad

Despite those promising economic indicators, other data signals potential challenges ahead:

- A December 2023 study by renowned academics for the National Bureau of Economic Research indicated that about 44% of banks’ office loans are underwater (equity-to-loan value), with vacancies soaring. The study noted that a 10% default rate on broader commercial real estate (CRE) loans would result in about $80B in bank losses. Some fear that the drag of higher rates on the 1-4 family housing sector has created a multifamily housing bubble.

- The research group “MSCI Real Capital Analytics” reported last summer that the community and regional bank share of the U.S. CRE market had exploded from 17% to 27% just since the pandemic. While the smaller banks have increased their CRE loans, investors and larger institutions have shed CRE exposures due to credit quality concerns and heightened regulatory scrutiny.

- Weaknesses in the trucking sector were at the heart of a recent Midwest bank failure — the first credit quality focused closure in quite a while.

- There’s a growing dichotomy between consumers living paycheck-to-paycheck (and running up credit card levels to historic heights) and those with strong balance sheets and investment resources. While this issue may be primarily affecting the credit union industry, it could impact bank performance as well.

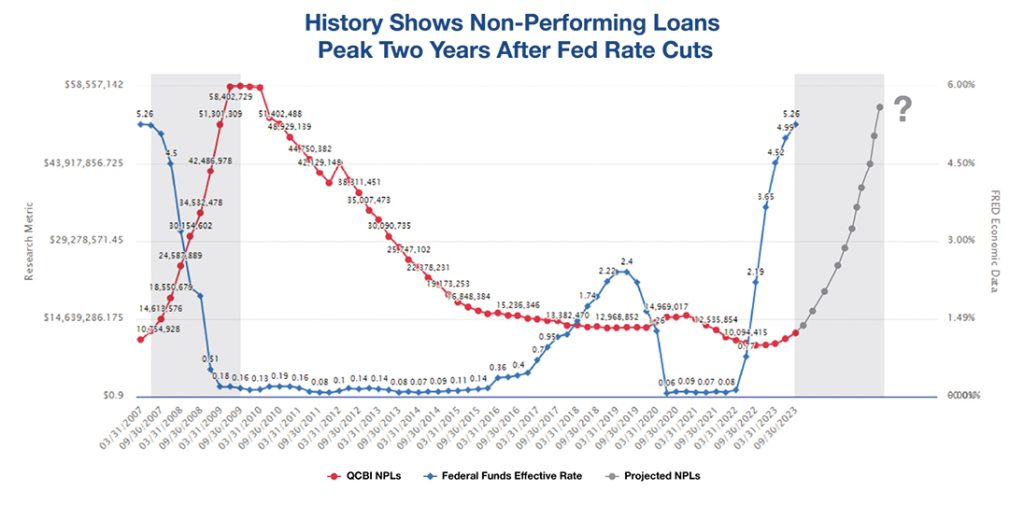

- The chart below of historical data from the “QwickAnalytics® National Performance Trends Report” (based on the proprietary QwickAnalytics Community Bank Index (QCBI) of true community banks) clearly indicates an approximate two-year lag between the end of rate hikes and the peak of non-performing loans (NPLs). This may be the most telling data supporting the continuing need for credit risk management vigilance!

The Now

It’s clear that, given all of the data listed previously, those directly responsible for your bank’s credit portfolio performance must stay vigilant. Consider directing attention to these key areas:

- Accept that regulatory scrutiny is increasing significantly, particularly in the CRE arena. Be sure to reinforce your adherence to both the December 2006 “Interagency Guidance on CRE Concentrations” (Fed SR7-1) and the more recent June 2023 “Prudent CRE Loan Accommodations and Workouts” (Fed SR23-5). Be proactive in anticipating CRE repricing and performance, monitoring concentrations unique to your bank and ensuring that management and the board are fully informed.

- Enhance all aspects of loan review — whether performed internally (annually) or by an external independent provider — and ensure the quality and experience levels of those performing the reviews are up to the task. Remember, loan review is one of the most reliable tools for early detection of credit risk — a proven corollary to reduce loan losses.

- Perform stress tests, preferably paired with loan reviews, that go beyond providing theoretical losses. Also, focus on suspect borrowers who could potentially move the needle on losses higher.

- Embrace practical and affordable portfolio analysis tools that provide early detection of weakening trends and emerging hotspots, particularly within your bank’s lending concentrations. Your loan portfolio is your DNA, so know what it is telling you before regulators arrive. Smaller banks remain laggards in this area. Waiting for call report data to depict loan quality is a fool’s errand because, as they say, “Those horses are already out of the barn.”

We all join in the optimism of the lending officer ready to put recession fears behind them, but history and current conditions mandate that the industry keep its guard up and manage what appears poised to be the greatest level of credit stress since 2008’s Great Recession.

David Ruffin is Principal of IntelliCredit, a division of QwickRate. He has extensive experience in the financial industry, including a long and pronounced emphasis on credit risk in a variety of roles that range from bank lender and senior credit officer to the co-founder of IntelliCredit and its technology that is revolutionizing a decades-old loan review process. For more information, visit intellicredit.com or email info@intellicredit.com.